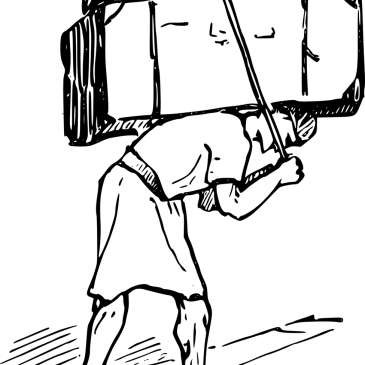

SM (ed. 1) Debt constrains our future

Have you ever wondered why economic conditions are challenging, despite easy access to credit for cars, homes and shopping? In this edition of the Sound Money Monthly we cover one the most important macroeconomic trends, debt. (16 minute read) TLDR: Economic growth, job quality and social mobility are declining. Yet the policy response is the cause … More SM (ed. 1) Debt constrains our future